Invest where Performance Meets Possibility

THE51 FUND III

Fund III captures one of the most overlooked opportunities in venture, women-led innovation driving the future economy. Focused on high-growth, tech-enabled companies, it combines disciplined capital with the reach of The 51’s 45,000-strong community of investors, founders, and partners to unlock growth that reshapes industries and returns alike.

WHY FUND III. WHY NOW.

A Market Shift You Can Measure

A global wealth transfer is underway, and women are at the center of it. By 2030, women will control nearly half of Canada’s $4 trillion in assets, reshaping who holds capital, who allocates it, and who defines its impact.

Yet, despite decades of data proving performance, only 2% of venture capital reaches women-led companies. This imbalance isn’t a social issue, it’s a market inefficiency. One that creates a powerful opening for investors who move early and decisively.

Fund III is designed to capture this shift, investing where women are leading innovation, driving demand, and creating durable economic value. It’s not just a fund for this moment; it’s a fund built because of it.

Born from Results

WHAT FUND III IS BUILT FOR

Built for Scale

Fund III is The 51’s next stage of disciplined growth, a venture fund designed to accelerate women-led innovation at scale. We invest from pre-seed to Series A in high-growth, tech-enabled companies where women are shaping markets as founders, executives, and decision-makers.

Our focus spans three sectors driving long-term economic transformation: health, wealth, and work. In each, women represent the market majority, the buyers, operators, and innovators defining demand and setting new performance standards.

Fund III builds on The 51’s established platform of capital, expertise, and national reach. With institutional-grade governance and the strength of a 45,000-member community, the fund channels opportunity into measurable growth, for founders, investors, and the future of the economy.

Backing the Sectors Shaping Tomorrow’s Economy

WHERE WE INVEST

Fund III targets scalable, technology-enabled ventures in three sectors where women drive demand, shape markets, and create long-term value. Each represents a high-growth opportunity defined by both market size and market shift.

01

-

We invest in technology-driven solutions advancing reproductive, mental, and age-related health, personalized wellness, and modern caregiving. Our focus spans both individual consumers and the organizations that serve them, meeting rising demand for smarter, more effective models of care.

$88 B Market by 2030

02

-

We invest in tools that support personal and professional financial management, from budgeting, saving, and investing to planning platforms that help individuals and families manage wealth with precision. We also back innovations that help multi-generational caregivers navigate household finances and career advancement, meeting the evolving financial needs of a changing economy.

$29 B Market by 2030

03

-

We invest in marketplaces and enterprise solutions that reimagine how work is structured, delivered, and valued. From flexible work models to platforms that drive career growth and caregiving balance, our focus is on technologies aligned with how people want—and need—to work today.

$81 B Market by 2028

At The51, we don’t just deploy capital, we move it with purpose. Our edge lies in how we pair institutional discipline with the scale and momentum of a national community. Fund III is built on a platform where capital, networks, and market expertise work in concert to accelerate growth from day one.

Capital & Community, Side by Side.

Capital & Community, Side by Side.

WHY THE51

-

Experienced General Partners, LP advisory committees, and transparent oversight ensure rigor, accountability, and confidence at every stage.

-

A blended LP base of institutions, family offices, and accredited investors strengthens capital resilience and fuels follow-on deal flow across markets.

-

Our 45,000+ member network provides early customer access, industry insight, and brand visibility, giving founders a competitive edge that extends far beyond funding.

-

Founders seek us out for more than capital. The51 brings operational experience, strategic guidance, and trusted partnership that turn early traction into scale.

Built on Experience, Positioned for Growth

OUR TRACK RECORD

The51 has built one of Canada’s most active women-led venture platforms, disciplined in execution, expansive in reach, and grounded in measurable results. Each fund, investment, and LP strengthens the foundation that Fund III is now built to scale.

34+

Investments

200+

Accredited LPs

$71M+

Capital Catalyzed

4,000

Ventures Reviewed

The Investor Opportunity

Fund III offers investors disciplined exposure to a high-performance, undercapitalized segment of the venture market. Our structure meets institutional mandates for governance, reporting, and returns, while capturing the upside of a structural market shift driven by women-led innovation.

-

We offer access to a proven, scalable investment strategy supported by disciplined capital deployment, transparent reporting, and strong governance. Fund III provides exposure to an emerging asset class, women-led innovation, aligned with institutional performance and impact mandates.

-

For family offices, Fund III delivers a pathway to long-term, resilient growth. We provide access to early-stage opportunities that diversify portfolios, align with generational wealth strategies, and connect capital to real economic growth.

-

Fund III extends mission-driven capital into market-based investing. We combine financial performance with systemic outcomes, ensuring every dollar deployed creates both measurable returns and sustained economic participation.

-

Fund III gives accredited investors access to venture opportunities traditionally out of reach. Through The51’s platform, investors gain exposure to high-potential ventures, curated deal flow, and a national network of peers and operators driving growth across industries.

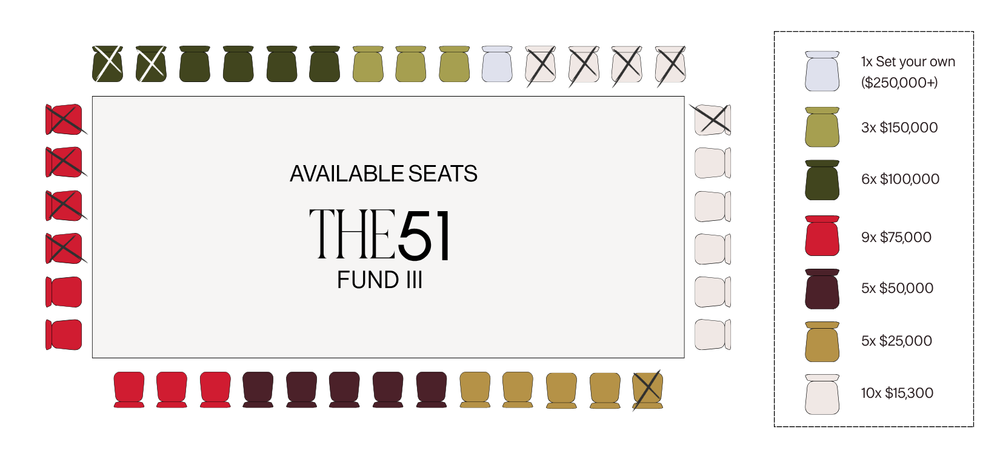

Participation in Fund III begins with membership in The51. Every investor, whether Explorer or Champion, joins a national community of capital holders, operators, and founders working side by side to build the future of venture.

Membership isn’t a formality; it’s an advantage. It connects you to deal flow, insights, and engagement opportunities that extend beyond investment, through curated events, founder roundtables, and strategic introductions that strengthen portfolio growth and network reach.

Members can also choose to direct their annual fee toward founder enablement, supporting coaching, advisory, and growth programs that help our portfolio companies scale faster.

Builders

Where Investors Become

INVESTOR MEMBERSHIP

Invest in the Future of Capital

EXPRESS YOUR INTEREST

This form serves as a formal expression of your interest in investing in Fund III. While not a binding agreement, it indicates your intent to participate at your selected investment level. Completing the form reserves your seat and enables our team to follow up with subscription documentation for your review and signature.

*This opportunity is open exclusively to accredited investors.

Fund III FAQs

-

While full fund financials are reserved for our LPs, both Fund I (2020 vintage) and Fund II (2022 vintage) are currently benchmarking in line with the same vintages across all key fund metrics (TVPI, DPI, Net IRR - less fees and expenses). The51 investment team takes a hands-on approach with our founders, leveraging our deep community and network to accelerate growth, strengthen governance, and prepare companies for scale and eventual exit.

-

Our first two funds were designed for individuals, family offices, and foundations. Fund III will be institutionally led, while still allowing our existing community of individuals, family offices, and family foundations to invest alongside larger institutional investment. Our target of $30M will come from a mix of institutional LPs, family offices, foundations, other VC funds, and individuals. The institutional-led $51M Food & AgTech Fund, gives us strong conviction in our ability to raise a $30M fund well-aligned with our thesis and opportunity.

-

Fund III proposes a 2.5% management fee during the investment period, which is the most resource-intensive stage of the fund’s life cycle. These fees are allocated exclusively to fund management and operations. That said, The51 investment team takes a high-touch approach with our portfolio: we coach founders closely, engage deeply, and leverage our extensive network in service of the companies to maximize performance. Our level of founder engagement is significantly higher than many peers, which is a key part of our value proposition. Following the active investment period, management fees drop to 2%.

-

Strong governance is central to how we manage our funds. We are committed to transparency, accountability, and alignment with our investors. Each fund has an LP Advisory Committee (LPAC) composed of Limited Partners (investors in the fund). The LPAC provides guidance on matters such as conflicts of interest, valuation, and other key governance considerations. This committee ensures that investor voices are represented in oversight and decision-making.

In addition to the LPACs, we have established a General Partner Advisory Committee(GPAC). The51 leverages a network of highly skilled, influential and well-regarded individuals to help guide their investment decisions. The committee supports the General Partner in upholding best practices and evolving the governance structure as our funds grow.

Together, these governance bodies ensure that our investors are engaged, that decisions are made with integrity, and that our funds continue to operate in the best interests of both founders and Limited Partners.

-

Funds I and II operated on a subscription model where a one-time annual contribution was made over three years, maximizing predictability for investors. Fund III will either operate on a similar subscription model or a traditional capital call model. This detail will be determined based on agreed to terms with an anchor institutional investor. The structure will seek to balance investor convenience with maximum returns.

-

Joining the first close offers advantages common across venture funds: your capital is put to work earlier, and later investors typically pay an interest catch-up to recognize both the time value of money and the higher risk you assumed. First-close investors are recognized for taking early conviction. They gain earlier access to fund reporting, have greater visibility in the fund’s narrative, and have earlier opportunities to participate in co-investment.